Activate via the Citi Mobile® App or Citibank Online.

Make the move to Citi Mastercard today.

Activate the Citi PremierMiles Mastercard

With the growth of our partnership with Mastercard, we are progressively converting the Citi PremierMiles Visa Card to the Citi PremierMiles Mastercard. As part of our sustainability efforts, the Citi PremierMiles Mastercard is made from recycled material.

What will stay the same

Outstanding balance, available Citi Miles, Citi PayAll & Citi instalment loan(s)1 and/or balance transfer(s) will transfer to Citi Mastercard

1.2 Citi Miles2 for every S$1 local spent & 2.2 Citi Miles2 for every S$1 foreign currency spent

Register for a new Priority Pass membership associated with your Citi PremierMiles Mastercard using the new unique invitation code from Citi Mobile® App to enjoy complimentary visits3 to airport lounges worldwide

Citi Credit Card benefits, credit limit, fees and terms4

No expiry2 on Citi Miles

Wide range of dining, shopping & travel deals via Citi World Privileges5

What will change

New credit card number, CVV & expiry date

A card that is sustainable & eco-friendly

Foreign currency conversion6

Mastercard priceless specials

All recurring payments need to be re-established

How to activate the new Citi Mastercard

- Citi Mobile® App and Citibank Online (Main cardmember)

- Citi Mobile® App and Citibank Online (Supplementary cardmember)

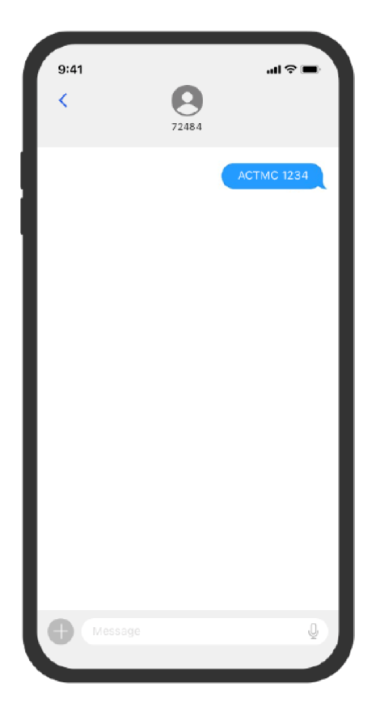

- SMS or Phone

How to activate via Citi Mobile® App and Citibank Online

How to activate via Citi Mobile® App and Citibank Online

Citi Mobile® App

| Log in and click “Manage” on “the Homescreen” | |

| Tap on ”Activate your new card” | |

| Enter the CVV and tap “Activate” |

Citibank Online

| Visit www.citibank.com.sg. Click on “Sign On”, followed by “Citibank Online” | |

| Under “Services” > “My Profile”, click on “Card Activation (Local)” | |

| Follow the steps on-screen to complete your activation |

How to activate via SMS or Phone

Main Cardmember: SMS ACTMC <space> last 4-digit

of Mastercard card number

Supplementary Cardmember: SMS ACT <space> last

4-digit of Mastercard card number

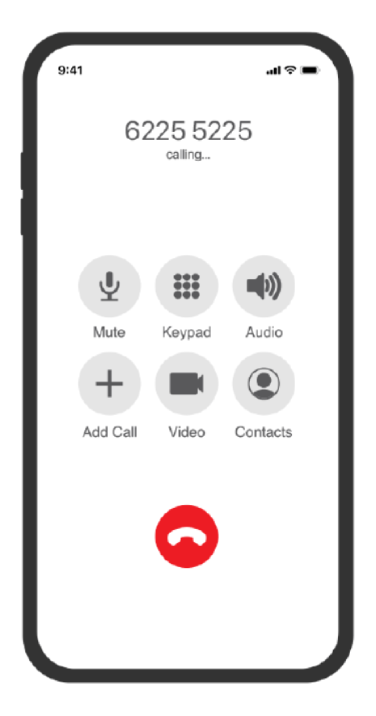

Contact our Citiphone hotline

at 6225 5225

Welcome to the world of Mastercard

Experience the convenience of a card that is accepted at over 47 million merchants in more than 210 countries and territories.

Frequently Asked Questions (FAQs)

With the growth of our partnership with Mastercard, we are progressively converting your Citi Visa credit card to the corresponding Citi Mastercard. In line with this move, your Citi Visa credit card will be discontinued on the date specified in the email we have sent you. We have also sent you a Citi Mastercard so you can continue to enjoy the benefits offered by your Citi Credit Card.

If you choose to activate the Citi Mastercard, any outstanding balance (credit or debit), available Citi Miles/Citi ThankYouSM Points/Citi ThankYouSM Rewards/cash back, Citi PayAll and Citi instalment loan(s) and/or balance transfer(s) - where applicable - will be transferred from your Citi Visa credit card to Citi Mastercard.

The Citi Mastercard for both main and supplementary cardmembers are being sent to the mailing address of the main cardmember. You can expect to receive the cards within 3 weeks.

If you do not wish to activate the Citi Mastercard, your Citi Visa credit card will be discontinued on the date specified in the email we have sent you.

To continue enjoying your Citi credit card benefits, please activate your Citi Mastercard for a seamless conversion of your unutilised Citi Miles/Citi ThankYouSM Points/Citi ThankYouSM Rewards/cash back on your Citi Visa credit card to your Citi Mastercard.

Once you have activated the Citi Mastercard, you can no longer use your Citi Visa credit card. Similarly, once your supplementary cardmember activates the supplementary Citi Mastercard, the supplementary Citi Visa credit card can no longer be used.

Your supplementary cardmember is required to activate the supplementary Citi Mastercard within 90 days upon the activation of the main Citi Mastercard or before the discontinuation of the supplementary Citi Visa credit card, whichever is earlier. If the supplementary Citi Mastercard is not activated within this period, the supplementary Citi Visa credit card will be terminated.

Yes, you will need to add the Citi Mastercard to your mobile wallet after you have activated it.

No. If you have an existing ATM pin on your Citi Visa credit card, it will remain the same for the Citi Mastercard.

The annual fees and supplementary card fees on the Citi Mastercard are currently the same as on your Citi Visa credit card. You will continue to pay the fees on the same card anniversary date as before.

You will need to activate the main Citi Mastercard before the date when your main Citi Visa credit card will be discontinued. This date is specified in the email we have sent you.

You will need to activate the supplementary Citi Mastercard within 90 days from when the main cardmember has activated the main Citi Mastercard or before the supplementary Citi Visa credit card will be discontinued, whichever is earlier. The date when the supplementary Visa credit card will be discontinued is specified in the email we have sent the main cardmember.

Please note that the main cardmember will need to activate the main Citi Mastercard first, before the supplementary cardmember can activate the supplementary Citi Mastercard.

1. You will not be able to use your main Citi Visa credit card anymore.

2. Any outstanding balance on your Citi Visa credit card will be transferred to the Citi Mastercard by the following day after your have activated the Citi Mastercard.

3. All instalment loan(s) and/or balance transfer(s) on your Citi Visa credit card will be transferred to the Citi Mastercard by the following day after you have activated the Citi Mastercard. After the transfer, there will be no change to the existing loan tenure as per your Citi Visa credit card.

4. The Citi Miles/Citi ThankYouSM Points/Citi ThankYouSM Rewards/cash back available on your Citi Visa credit card will be transferred to the Citi Mastercard by the following day after you have activated the Citi Mastercard. There will be no change to expiry date, if applicable, for the Citi Miles/Citi ThankYouSM Points/Citi ThankYouSM Rewards/cash back transferred to the Citi Mastercard.

5. Citi PayAll arrangements that have been established on your main Citi Visa credit card will be transferred to the main Citi Mastercard by the following day after you have activated the Citi Mastercard.

If there are any Citi PayAll arrangements which have been established by your supplementary cardmember on the supplementary Citi Visa credit card, such arrangements will continue for a period of 90 days if the supplementary cardmember has not activated the supplementary Citi Mastercard. If the supplementary cardmember has activated the supplementary Citi Mastercard, the PayAll arrangement will transfer to the supplementary Citi Mastercard.

6. As your card details will change, any recurring payments will need to be re-established with the relevant merchant/billing organisation with the new Citi Mastercard details.

1. You will not be able to use your supplementary Citi Visa credit card.

2. Any Citi PayAll which have been scheduled on your supplementary Citi Visa credit card will be transferred to the Citi Mastercard.

3. As your card details will change, any recurring payments will need to be re-established with the relevant merchant/billing organisation with the new Citi Mastercard details.

Please note that the main cardmember will need to activate the main Citi Mastercard first, before the supplementary cardmember can activate the supplementary Citi Mastercard. The supplementary cardmember will need to activate the supplementary Citi Mastercard within 90 days from when the main cardmember has activated the main Citi Mastercard or before the date the supplementary Citi Visa credit card will be discontinued, whichever is earlier. The date when the supplementary Visa credit card will be discontinued is specified in the email we have sent the main cardmember.

From the date when your Citi Visa credit card is discontinued:

1. Your Citi Visa credit card (main and supplementary, if any) will be discontinued.

2. You can no longer make new transactions, set up new Citi PayAll, take up new loans/extend existing loans or apply for credit limit adjustment/ new supplementary card.

3. You can no longer redeem Citi Miles/Citi ThankYouSM Points/Citi ThankYouSM Rewards/cash back. Any available Citi Miles/Citi ThankYouSM Points/Citi ThankYouSM Rewards/cash back will be forfeited.

4. Any recurring bill arrange ments will be cancelled.

5. Any Citi PayAll payment arrangements (one-time or recurring) will be cancelled.

6. Even though your Citi Visa credit card (main and supplementary, if any) is discontinued, any outstanding instalment loan(s) and/or Balance Transfer loans will remain effective as per existing loan tenure and will continue to reflect on your monthly statement until full payment is made or until the end of the loan tenure. Please note that interests and charges will continue to apply in accordance with the terms of your loans or instalment payment plans or cardmembers agreement for all outstanding balances.

From the date when your supplementary Citi Visa credit card is discontinued:

1. You can no longer make new transactions or set up new Citi PayAll. Any Citi PayAll payment arrangements (one-time or recurring) scheduled from this date will be cancelled.

2. Any recurring bill arrangements scheduled from this date will be cancelled.

Yes, the eligible spending made on your Citi Visa credit card to qualify for existing campaigns will continue to apply after they are migrated to the Citi Mastercard after the Citi Mastercard is activated.

Yes, you will continue to view your previous statements via Citi Mobile® App or Citibank Online.

Your supplementary cardmember is required to activate the supplementary Citi Mastercard within 90 days upon the activation of the main Citi Mastercard or before the discontinuation of the supplementary Citi Visa credit card, whichever is earlier. If the supplementary Citi Mastercard is not activated within this period, the supplementary Citi Visa credit card will be terminated.

Both the main and supplementary Citi Mastercards are sent to the mailing address of the main cardmember. The main card needs to be activated first before the supplementary card can be activated.

The new Citi Mastercard is approved by Mastercard’s CEC (Card Eco Certification), as symbolised by the Mastercard Sustainable Card Badge, where the card is manufactured using sustainable materials - including ethically sourced, bio-sourced, ocean-sourced, or chlorine-free materials.

Yes. You will receive a new unique invitation code on the Citi Mobile® App within 10 working days after you have activated your Citi PremierMiles Mastercard. Complete your registration with your unique invitation code at www.prioritypass.com/citipremiermiles.

If you have previously registered for Priority Pass Membership with your Citi Visa credit card, the membership will be terminated.

View the Mastercard Conversion Program Terms & Conditions at www.citibank.com.sg/mctncs.

1Existing loan will include but not limited to Citi Quick Cash, Citi PayLite, Citi FlexiBill, Citi Balance Transfer or Citi FlexiBuy.

2Terms and Conditions apply. For more details, visit www.citibank.com.sg/premiermiles.

3Priority Pass membership is on application basis and is reserved for the Main cardmember only, limited to 2 complimentary visits per calendar year. Every accompanying guest will be considered as 1 visit of the 2 complimentary visits used. Thereafter, US$35 per person per visit (or at the prevailing rate) will be charged to the Citi PremierMiles Card account. (Note: Priority Pass airport lounge charge of US$35 per person per visit may also be charged in a different currency equivalent to US$35 per person per visit). Visit www.citibank.com.sg/prioritypass for more information.

4View the Citi PremierMiles Cardmember's Agreement at www.citibank.com.sg/tncs.

5For details on Citi World Privileges, visit www.citiworldprivileges.com.

6Foreign currency transactions will be converted and subject to Mastercard's foreign exchange rate.

As part of our commitment to fair dealing, we wish to notify you that the terms and conditions governing your product and/or service relationship with us contain clauses that give us the unilateral right to revise such terms and conditions. For the Notification of Right of Review Clauses, visit the Citibank Singapore website, click on Terms and Conditions at the bottom of the page, followed by General tab.