- Home

- |

- Deposits

- |

- Local Currency Accounts

- |

- Tap & Save Account

What is Tap & Save Account

A Tap & Save Account is a savings account that lets you enjoy a cash rebate of up to 1% when you use it for your daily spends. It also offers a higher interest of up to 0.13% p.a.* on your savings.

Cessation of EZ-Link Facility on your Citibank SMRT Debit Card

The Citibank SMRT Debit Mastercard you currently hold comes with the EZ-link facility that allows you to store value and make fare payments for your daily commute. We would like to inform you that all new, replacement and renewal cards issued on and after 12 December 2023 will no longer come with the EZ-link Facility.

Existing cardholders can continue using their Citibank SMRT Debit Mastercard for commutes until either card expiry or cessation of the EZ-link Facility by SMRT, whichever is earlier. Thereafter upon card expiry, replacement or renewal, a new card without EZ Link will be issued.

The 1% cash rebate that you currently enjoy on your daily spends will be unaffected and will continue to be credited into your Tap & Save Account.

Benefits of Tap & Save Account

- Enjoy competitive interest of up to 0.13% p.a.*

- Enjoy 1% cash rebate on everything from coffee to shopping**

Eligibility Criteria to Apply for a Tap & Save Account

| Eligibility Criteria | Yes | Aged 18 and above |

Features of a Tap & Save Account

| Checking facilities | Yes |

|

| Rebates | Yes |

SPEND: 1% rebate on daily expenses |

| Interest Earning | Yes | SAVE: Higher interest on your savings of up to 0.13% p.a.* |

| Online Banking | Yes | Pay Anyone online cheque payment service, direct transfer of funds between accounts |

| Phone Banking | Yes | CitiPhone Banking and Automated Voice Response |

| Citibank Debit Card | Yes | Free Citibank Debit Card with access to Citibank ATMs as well as merchants worldwide |

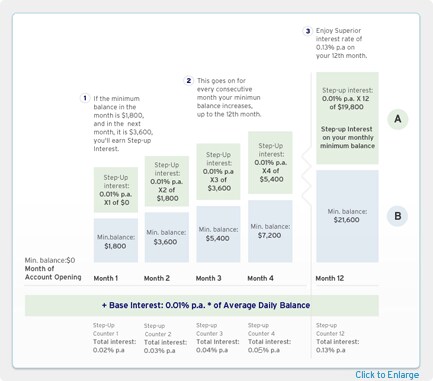

How Interest Steps up on Tap & Save Account:

You start with a base rate of 0.01% p.a.* This steps up to 0.13% p.a.* over a 12-month period as your balance increases in consecutive months. Simply bank your monthly salary into your Tap and Save Account for it to happen.

Interest-Earning Components on Tap & Save Account:

Increase your minimum balance each month and you'll earn Step-Up Interest.

Importance of Maintaining your balance on Tap & Save Account

In the event that your current month's minimum balance falls below the previous month, your step up counter will be reset to 9, 6, 0 depending on the minimum balance in your account.

Upon attaining the maximum of 0.13% p.a.* (after 12 counters of step up), maintain a minimum balance of S$20,000 OR ensure that your current month's minimum balance is greater than the previous month's minimum balance to continue to enjoy the superior interest of 0.13% p.a*.

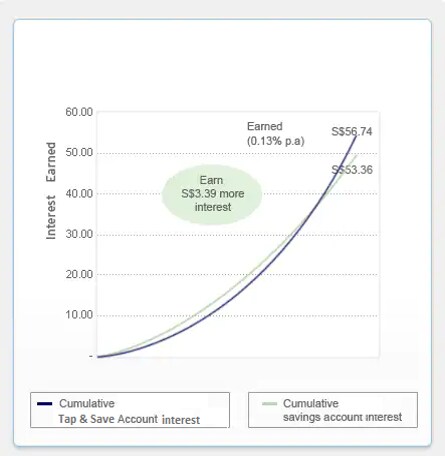

Comparison between Tap & Save Account and Savings Account

How Tap & Save Account compares to an ordinary savings account

Let's assume you credit a salary of S$3,000 to your Tap & Save Account, spend S$1,200 and save the remaining S$1,800 in the account every month. Over a period of 24 months, you would have earned interest of S$56.74 - S$3.39 more than what an ordinary savings account has to offer!

*Computation is based on illustration assumption only.

Click on  to expand and on

to expand and on  to minimise the details.

to minimise the details.

Yes, you can apply for the account. However, your existing Citibanking Debit Card or ATM Card will be terminated upon the use of your new Citibank SMRT Debit Card at any ATM or debit point of sale. Your Citibank Tap and Save Account will become your new primary account for ATM cash withdrawal and debit purchases. You can still continue to maintain your existing deposit accounts with Citibank and access these accounts from your new Citibank SMRT Debit Card.

The revised account service fee and minimum total relationship balance requirements will be effective from

1st January 2017 for Citi Priority, Citigold and Citigold Private Client and will be effective from 1st February 2017 for Citibanking clients.

You will need to maintain a Total Relationship Balance (TRB) of minimum S$15,000 average per month for Citibanking, Citi Priority, Citigold and Citigold Private Client customers. Failing which, the account service fee of S$15 will be imposed on this account, respective to the banking relationship.

'Total Relationship Balance' is the sum of:

- The average daily balance of your checking, savings and deposit accounts,

- The average daily value of your investments, and

- All outstanding amount(s) payable on your secured loan accounts as of the date of your last statement.

Please note that if you choose to close the account within the first 6 months from account opening, a fee of S$50 will be applicable.

- Base interest is the basic interest that you will earn, just like your normal savings account. With this account, we are giving you a base rate of 0.01% p.a.*

- Step up interest is a unique component in addition to your base interest. This is innovatively designed to reward you more as you increase your savings with us.

- Base interest for the month is computed by multiplying the monthly base rate to the average daily balance of the month.

- Step up interest is computed by multiplying the monthly step up interest rate to the previous month's minimum balance.

This refers to the lowest balance that is in your account in the previous month.

If your minimum balance for the current month is less than that of the previous month, the table below will explain what your new step up counter is.

| Existing Counter in Previous Month | Minimum Balance of Current Month | New Step-Up Counter in Current Month |

|---|---|---|

| 0 to 5 | S$0 and above | 0 |

| 6 | S$10,000 and above S$5,000 to < S$10,000 S$0 to < S$5,000 |

6 6 0 |

| 7 | S$10,000 and above S$5,000 to < S$10,000 S$0 to < S$5,000 |

6 6 0 |

| 8 | S$10,000 and above S$5,000 to < S$10,000 S$0 to < S$5,000 |

6 6 0 |

| 9 | S$10,000 and above S$5,000 to < S$10,000 S$0 to < S$5,000 |

9 6 0 |

| 10 | S$10,000 and above S$5,000 to < S$10,000 S$0 to < S$5,000 |

9 6 0 |

| 11 | S$10,000 and above S$5,000 to < S$10,000 S$0 to < S$5,000 |

9 6 0 |

| 12 | S$20,000 and above S$10,000 to < S$20,000 S$5,000 to < S$10,000 S$0 to < S$5,000 |

12 9 6 0 |

Your step up interest increases every month so long as you satisfy the qualifying criteria. For example, for the first time that your current month's minimum balance is greater than your last month's minimum balance, your step up interest rate will be at 0.01% p.a.*. Next month, this step up interest rate will grow to 0.02% p.a.*. As long as you qualify for step up interest, this will increase up to the maximum interest rate (rate cap). The rate is capped once the addition of your base rate and step up interest rate hits 0.13% p.a.* (i.e. 0.01% p.a.* + 0.12% p.a.* = 0.13% p.a.*).

You will continue to enjoy the base interest rate of 0.01% p.a.* and step up interest rate of 0.12% p.a.* by:

- Continuing to ensure that your current month's minimum balance is greater than last month's minimum balance; OR

- Maintaining your balance above S$20,000.

Once you hit the maximum interest rate (rate cap), this gives you additional flexibility to continue enjoying the base interest rate of 0.01% p.a.* and Step-Up interest rate of 0.12% p.a.* without worrying about your current and last month's minimum balance.

The debit card and ATM cash withdrawal function on your new Citibank SMRT Debit Card can be used once you receive the Citibank SMRT Debit Card and the PIN.

You may use your Citibank SMRT Debit Card for public transit with SimplyGo.

Yes, you are able to use Citibank SMRT Debit Card for online purchases.

An error message will be displayed on the card reader if more than one ez-link card is detected. Please ensure that you take out the intended card for travel and tap it on the card reader.

For existing holders of Citibank SMRT Debit Mastercard with EZ-Link stored value facility, you may proceed to any Transitlink Ticket Office to request for a refund on any remaining stored value in your card anytime before card expiry.

Please contact our CitiPhone Banking at 6225 5225 between 8am to 8pm to report the loss of your Card immediately.

For existing cardholders of the Citibank SMRT Debit Mastercard with EZ Link stored value facility, Citibank will replace the card and also inform TransitLink to deactivate the EZ-Link function on your Card within 48 hours.

It is valid for three (3) years. Once the card reaches its expiry date, Citibank will issue you a new card.

No. There are no caps on the cash rebates that can be earned on the Citibank SMRT Debit Card.

No. Cash rebates are only earned when point-of-sale purchases are charged to your Citibank SMRT Debit Card and debited from the Tap & Save Account. Cash rebates will be credited directly into your account in the following month.

No. If you close your Tap & Save Account before the end of a calendar month, all cash rebates for that calendar month will be forfeited.

No. Cash rebates are given only for Debit point-of-sale transactions.

Your cash rebates are based on settlement date (date in which the merchant settles the transaction). The time difference between transaction date and settlement date varies but it should not be more than five (5) days. As a result of the time difference, some of your month-end transactions' cash rebates may be accorded to you in the following month instead.

Terms & Conditions:Terms & Conditions:

*All interest rates are subject to periodic review and may be revised at the bank's discretion. All rates are quoted on a per annum basis and are effective from 1 Aug 2011.

Base interest rate starts from 0.01% p.a., and is computed by taking the daily average balance at the end of the month. Your interest rate steps up each month, and up to a maximum of 0.13% p.a. over a 12-month period, if your minimum monthly balance is higher than the previous month's minimum balance. Step up interest is computed based on the preceding month's minimum balance. Both Base interest and step up interest are credited on the last day of the month (excluding Sunday and Public Holidays).Interest rates are subject to periodic reviews and may be reviewed at the bank's discretion.

The rates shown here are indicative only and quoted in % p.a. The rates are subject to change without prior notice and are not to be taken as an offer to contract. Citibank shall not be responsible for any loss or damage arising directly or indirectly from the use of or reliance of the information provided therein.

**Valid at merchants accepting Debit Card payments. Cash rebates will be credited directly into your account at the following month.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured. For more information, please refer to SDIC's website at www.sdic.org.sg.

The promotions, products and services mentioned in the referenced document are not offered to individuals resident in the European Union, European Economic Area, Switzerland, Guernsey and Jersey, Monaco, San Marino, Vatican, The Isle of Man, the UK, Brazil, New Zealand, Jamaica, Ecuador or Sri Lanka. The referenced document is not, and should not be construed as, an offer, invitation or solicitation to buy or sell any of the promotions, products and services mentioned therein to such individuals.

Citibank full disclaimers, terms and conditions apply to individual products and banking.