Click on  to expand and on to expand and on  to minimise the details. to minimise the details. |

|

What is an electronic advice? What is an electronic advice? |

|

| Electronic advice is an electronic version of your banking advices which is accessible via Citibank Online and sent to your email inbox. |

|

|

|

|

|

|

|

How do I enroll for this service? How do I enroll for this service? |

|

| To enroll for electronic advice, follow these simple steps: |

|

Click here to login to Citibank Online and enroll for E-Statement and E-Advices.

If you are already logged into Citibank Online, |

|

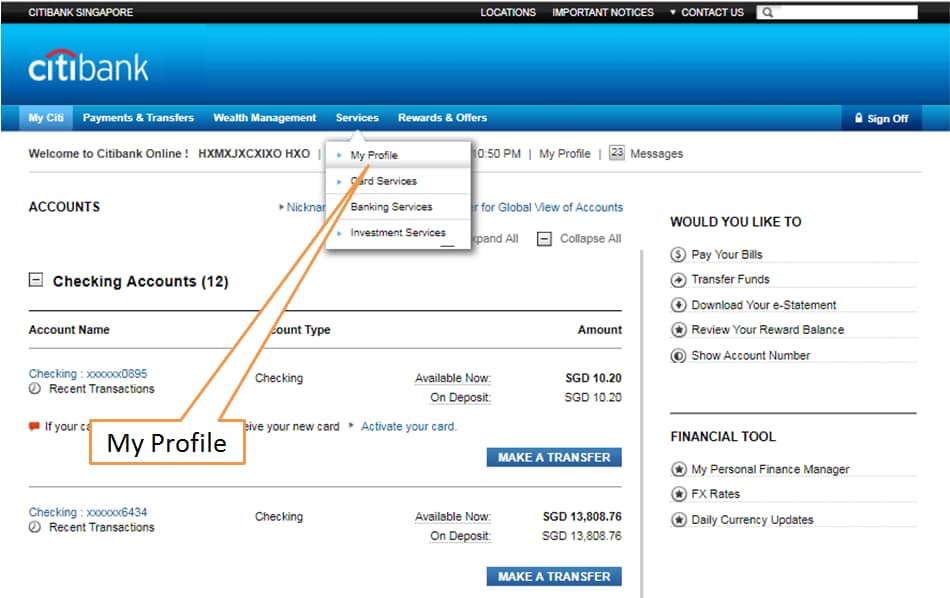

- Select <My Profile>,

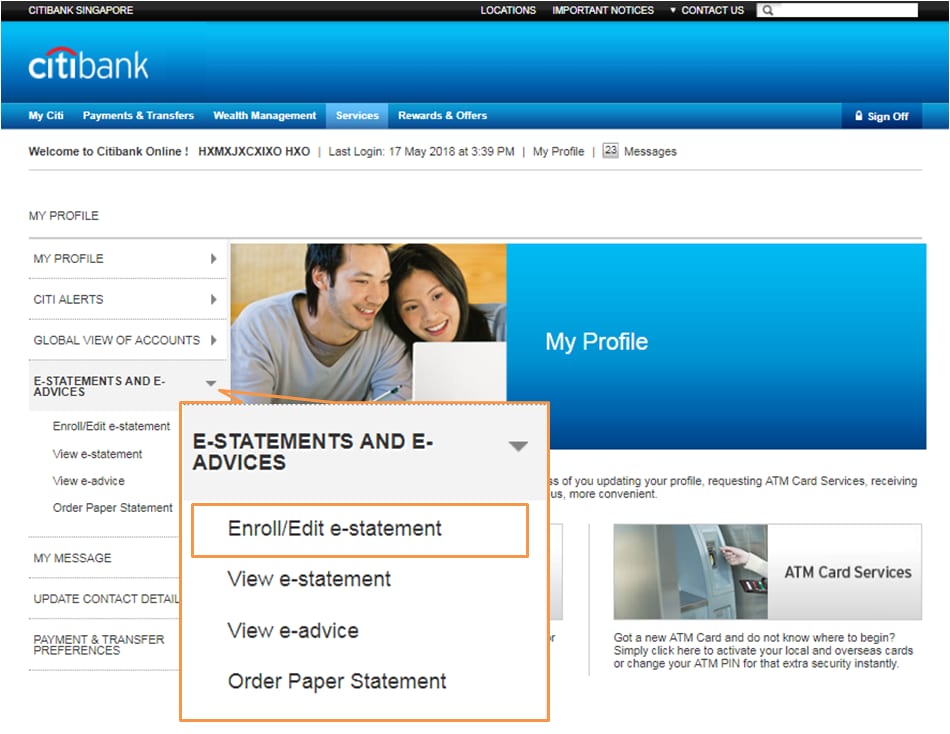

- Select <E-Statements and E-Advices> on the left panel

- Click <Enroll/Edit E-Statements>.

|

|

| You can choose to enroll for 'All Banking Statements', 'All Credit Card Statements' and/or 'All E-Advices'. |

|

| We will notify you by email or SMS once you have successfully enrolled for E-Statements and/or E-Advices. You will receive E-Statements from your next statement onwards; and E-Advices within the next 24 hours. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I prefer to receive my statements and/or advices by mail. I prefer to receive my statements and/or advices by mail. |

|

Login to Citibank Online and select <My Profile>.

Login to Citibank Online and select <My Profile>.

|

Select <E-Statements and E-Advices> and select <Enrol/Edit E-Statement> on the left panel.

Select <E-Statements and E-Advices> and select <Enrol/Edit E-Statement> on the left panel.

|

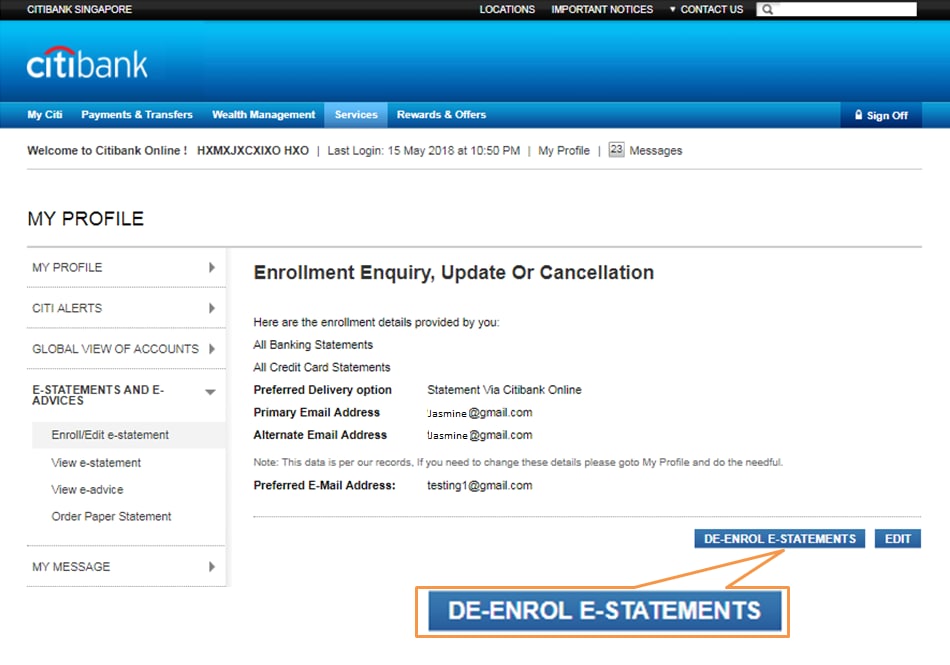

Click on <De-enrol E-Statements> and follow the confirmation steps to de-enroll from E-Statements.

Click on <De-enrol E-Statements> and follow the confirmation steps to de-enroll from E-Statements.

|

|

|

|

|

|

|

I wish to receive an SMS reminder 7 days before my Citibank Credit Card/Ready Credit bill is due. I wish to receive an SMS reminder 7 days before my Citibank Credit Card/Ready Credit bill is due. |

|

|

Set-up SMS notification, by clicking here to login to Citibank Online to access CitiAlerts settings. If you are already logged into Citibank Online:

|

- Select <My Profile>

- Select <Citi Alerts> on the left panel

- Click <Manage Alerts>

- Click <Edit Alerts> to view the different types of alerts available

- Select your preferences under <Alerts For My Credit Card And Ready Credit Accounts>

|

|

Click here to find out more about other CitiAlerts and reminders

|

|

|

|

|

|

|

|

|

|

|

|

|

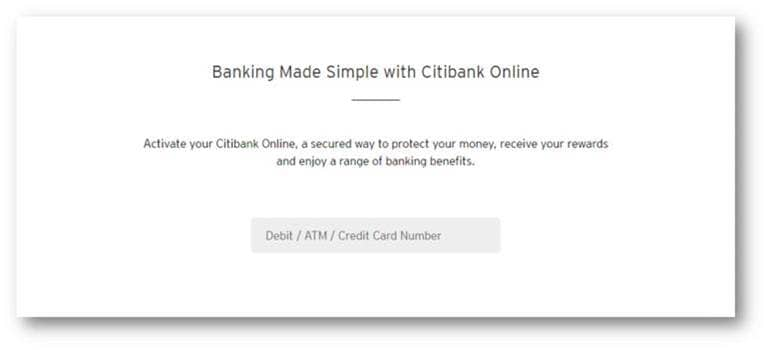

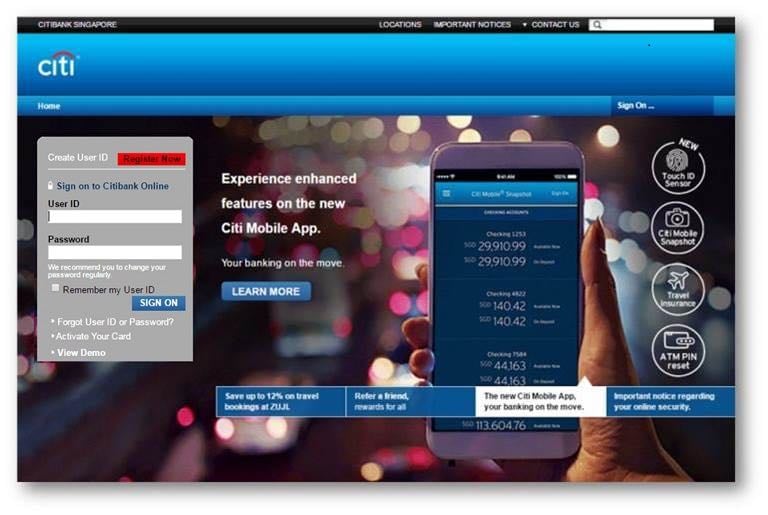

How do I register for my User ID and Password? How do I register for my User ID and Password? |

|

|

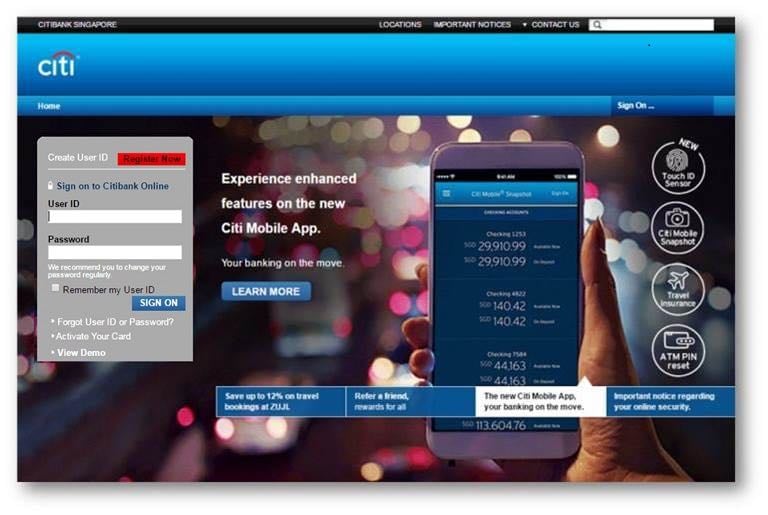

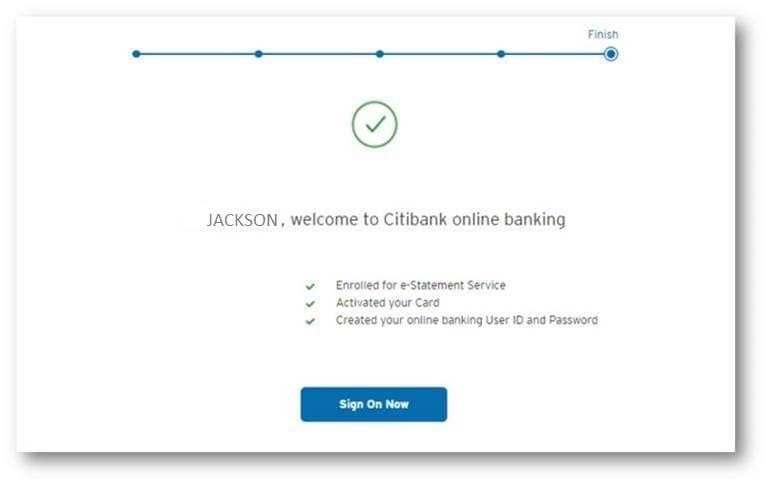

Please follow these steps to register for online banking account:

|

Click on "Register Now"

|

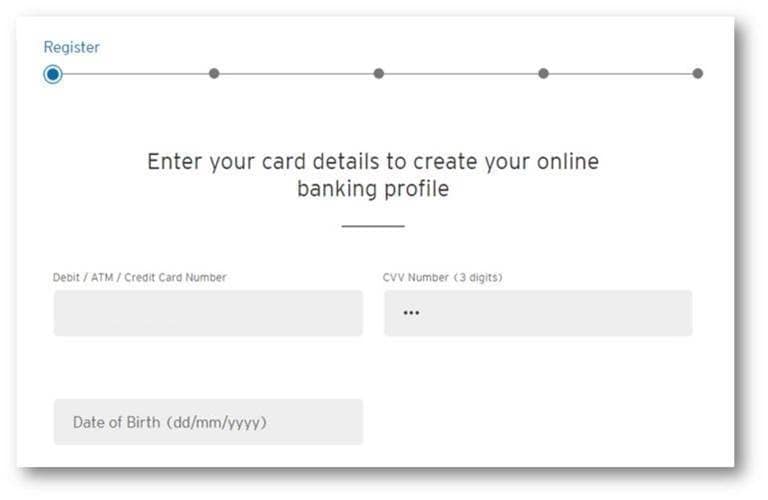

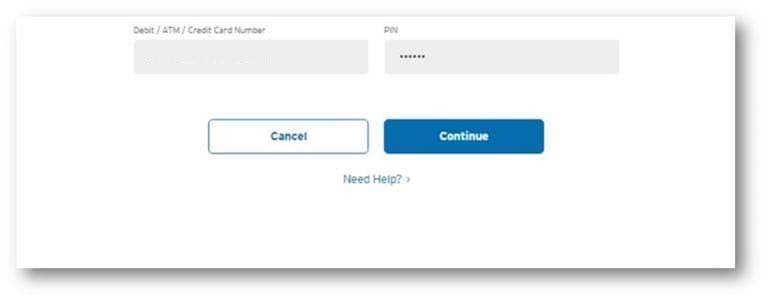

Step 1: Enter any of your Debit / ATM / Credit Card Number

|

For Credit Card enter CVV and your Date of Birth.

|

OR, for Debit / ATM Card, enter your Card PIN.

|

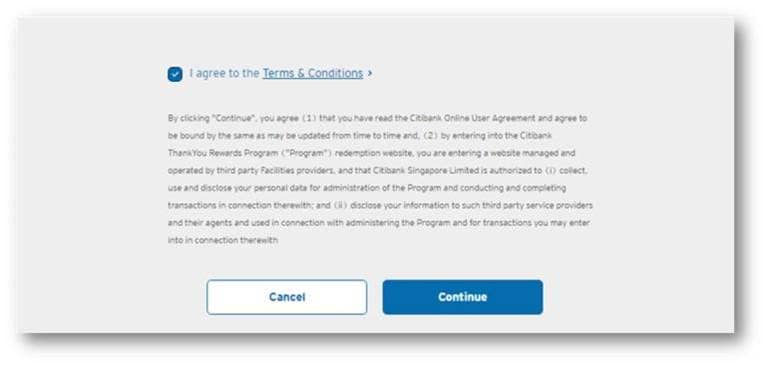

Read the Terms & Conditions from the link and click "I agree" checkbox. Click "Continue" to proceed.

|

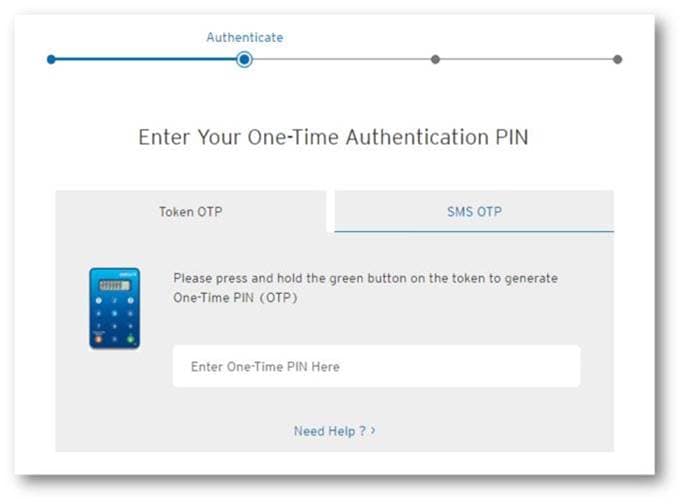

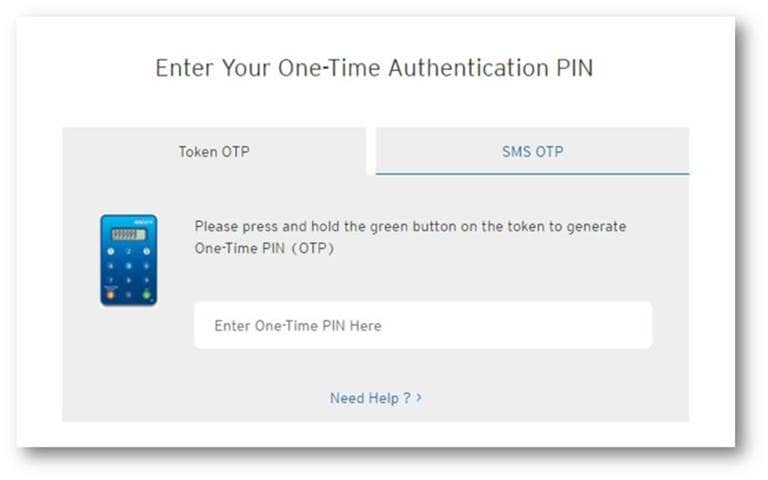

Step 2: Enter One-Time PIN (OTP) to proceed

|

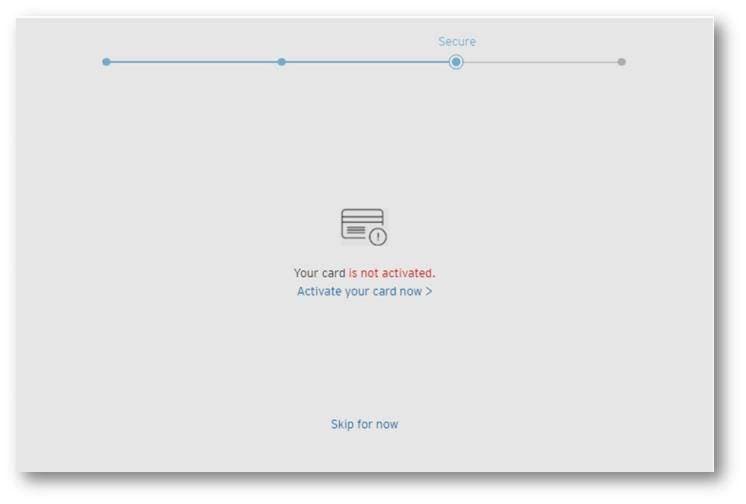

Step 3: Click on "Activate your card now". If your card is already active, please skip to the next step.

|

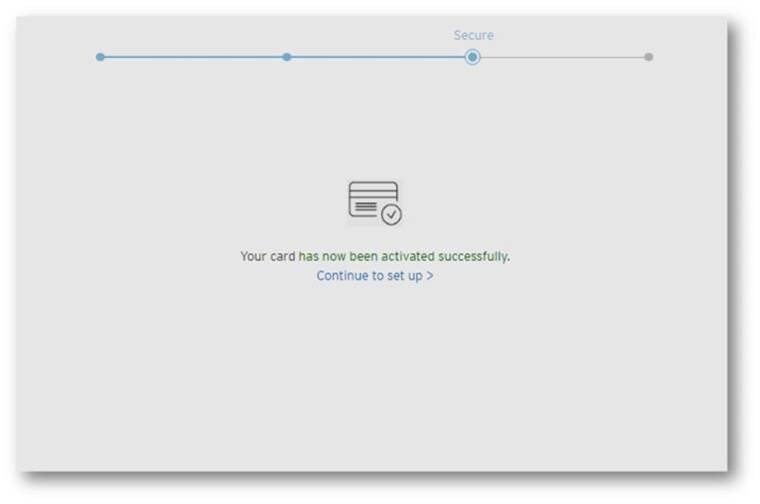

Click "Continue to set up" to proceed.

|

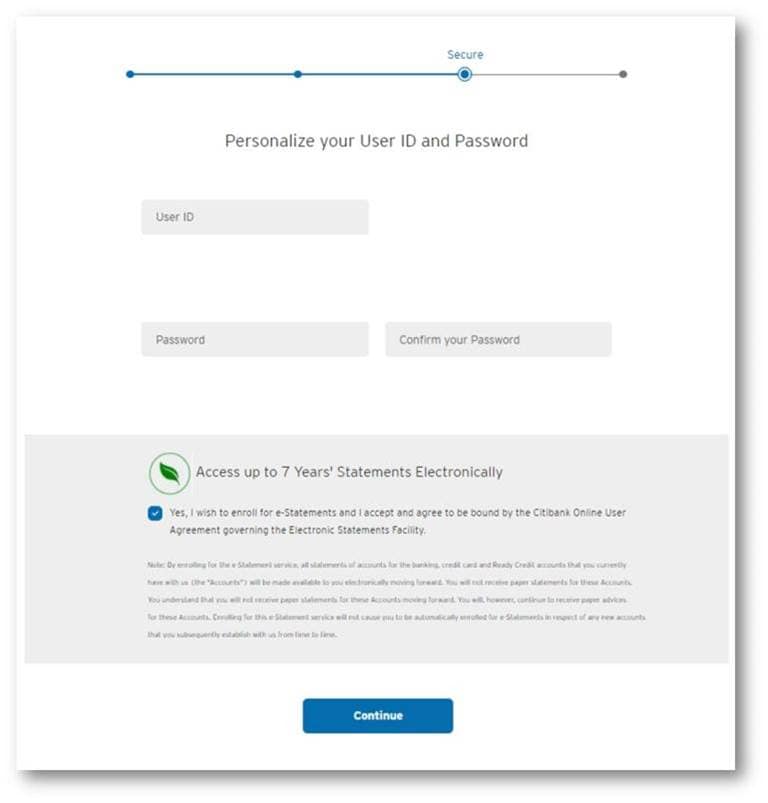

Enter your preferred User ID and Password

|

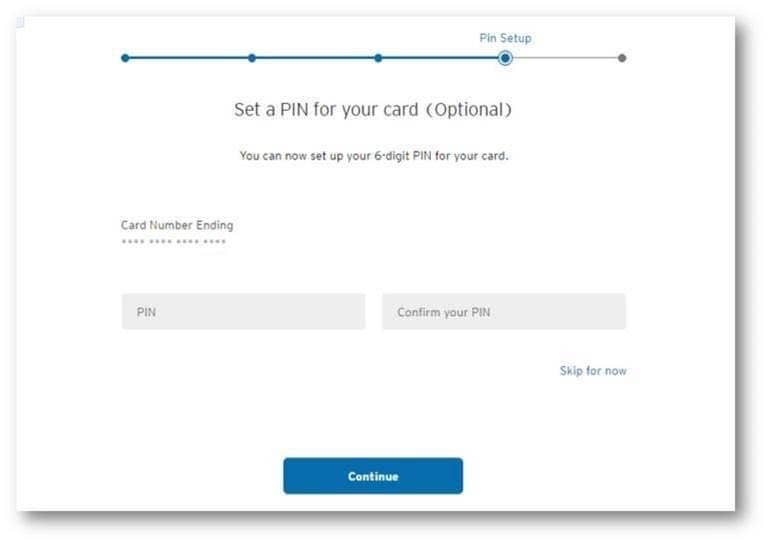

Step 4: Enter your preferred 6-digit PIN for your card (Optional). Click "Continue" to proceed.

|

Step 5: Registration Completed

|

|

|

|

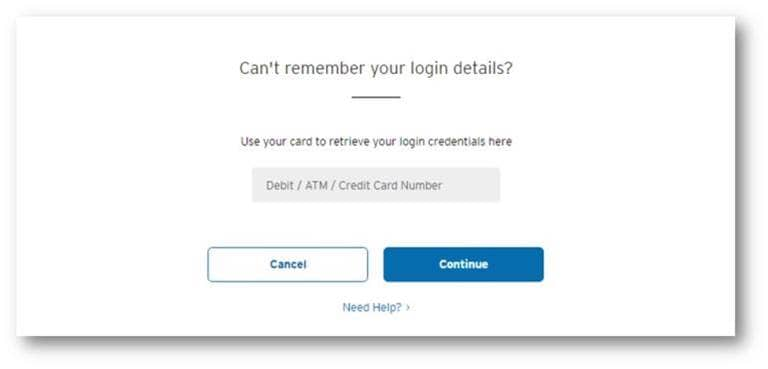

What happens when I forget my User ID and Password? What happens when I forget my User ID and Password? |

|

Click on "Forgot User ID or Password"

|

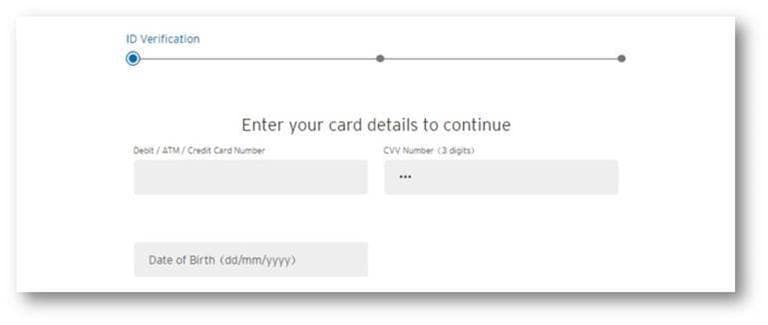

Step 1: Enter any of your Debit / ATM / Credit Card Number

|

For Credit Card, enter CVV and your Date of Birth. Click "Continue" to proceed.

|

OR, for Debit / ATM Card, enter your Card PIN. Click "Continue" to proceed.

|

Step 2: Enter One-Time PIN (OTP) to proceed

|

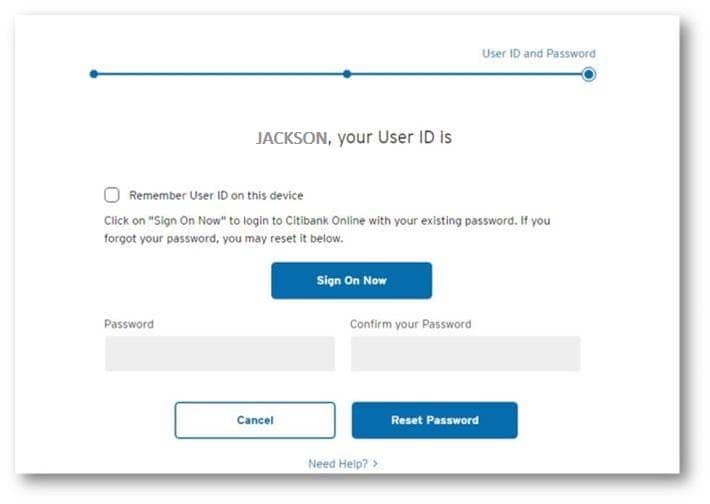

Step 3: Your User ID is shown on the screen. Click on "Sign On Now" to login to online banking with your existing password. If you forgot your password, you may reset it below.

|

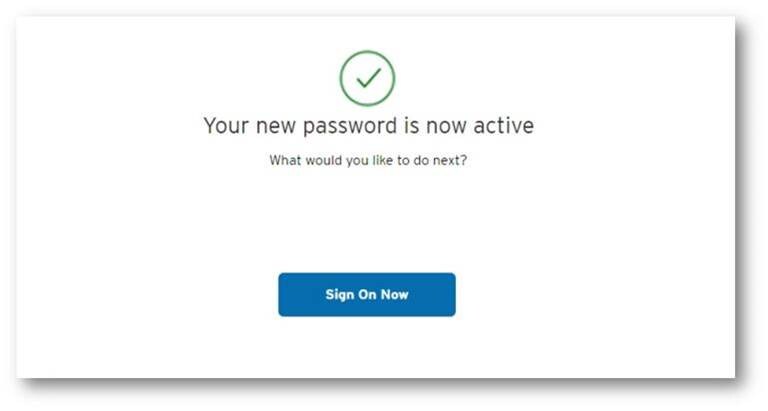

Step 4: Password reset completed. Click on "Sign On Now" to manage online banking account.

|

|

|