- Home

- |

- Banking

- |

- Instant Access

- |

- Online & Mobile Services

- |

- Mobile Services

- |

- Citi Mobile

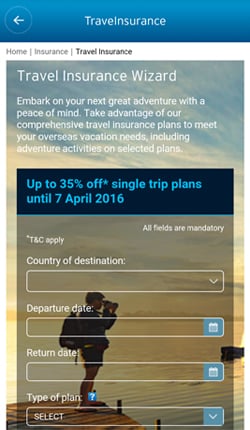

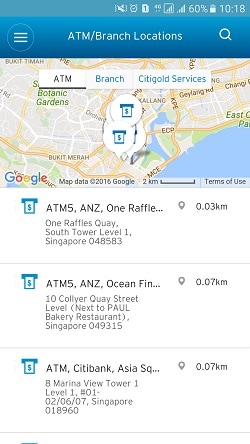

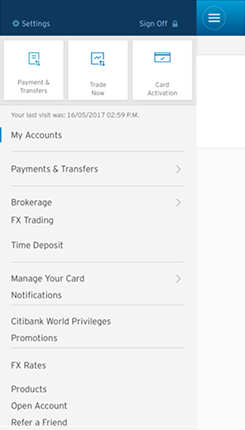

Download Citi Mobile® App, the companion app for your card to get the instant help that you need on-the-go.

Sometimes you just need an answer right away.

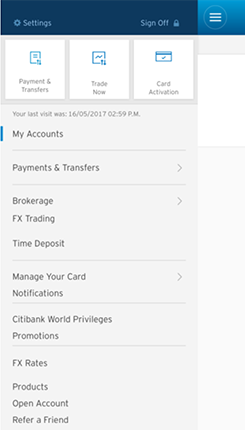

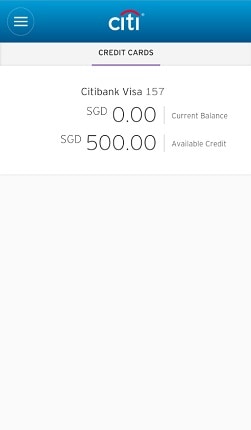

Check your cards or accounts balance anytime, anywhere

Need to check your cards or accounts balances? You can turn on Citi Mobile® App Snapshot to view your balances with one tap.

Track your payments in Citi Mobile® App

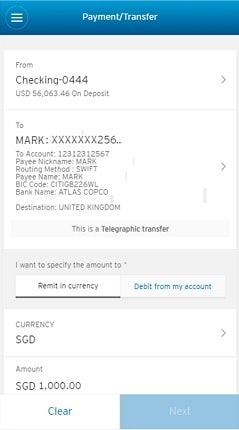

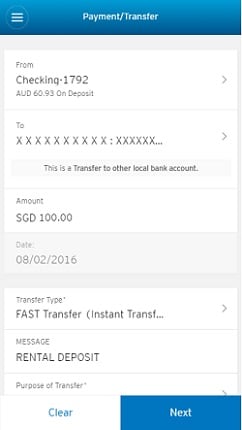

All your purchases, fund transfers, and payment details are instantly updated and can be retrieved anytime with the Citi Mobile® App. You can verify the last 150 transaction records, to ensure a merchant has charged you correctly before even receiving the credit card statement.

View current and past statements instantly

Your Citi Card statements are available at your fingertips. Retrieve all statements securely and privately in the Citi Mobile® App whenever you need to.

Protect your accounts right away.

Activate or de-activate your cards instantly

Not using your card? Use the Citi Mobile® App to temporarily de-activate your card so that no one can use it.* You can re-activate the card just as easily when you do need it.

*While your card is in a de-activated state, it will not be able to be used for point-of-sale transactions. However, any recurring payment instructions that you may have established on your card will not be affected. To terminate your card and request for a replacement if your card is lost or stolen, please call our Citiphone hotline.

Automatically notifies you of your account movements

Expecting a payment to your account or credit card? Is your time deposit reaching maturity? Left with a remaining credit limit of 5% on your credit card? Citi Mobile® App Push Notification will keep you informed of all these account movements, so that you can manage your accounts instantly, giving you peace of mind.

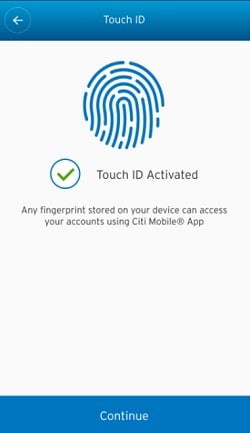

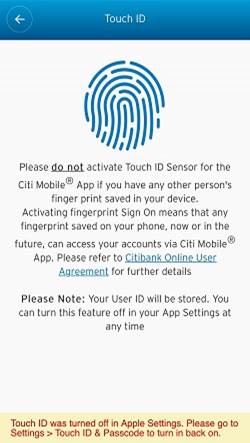

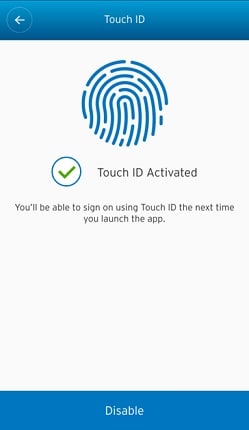

Access with your fingerprint

Too many passwords to remember? Access your account with your fingerprint, simply and securely.

Important information: Touch ID is only available on iPhone 5s and newer IOS devices supporting fingerprint login. Learn more here. Please do not activate Touch ID™ and Sensor for the Citi Mobile® App if you have any other person's fingerprint saved on your device. Activating fingerprint sign in means that any fingerprint saved on your phone, now or in the future can access your Citi Mobile® App. Your user ID will be stored in the app, you can turn this feature off any time via "Setting" feature. iPhone and Touch ID™ Sensor are trademarks of Apple Inc. registered in the U.S and other countries. Learn more here.

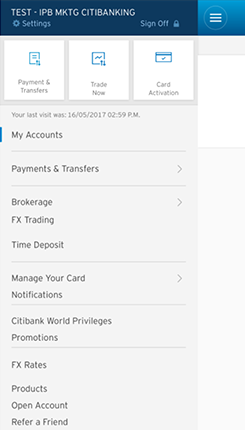

Say hello to the new Citi Mobile® App experience.

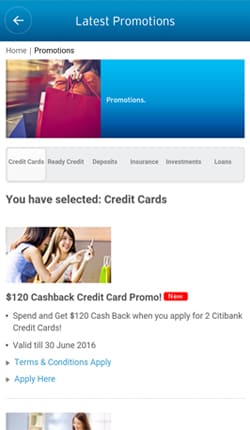

Get ready for an app that's quicker, easier to use, and most importantly, all about you. We've started with Citi credit card services, designed to give you control over your credit card matters with just a few quick taps, whenever or wherever you are.

You can now receive real-time notifications on your mobile phone. Enrol for push notifications on your

Citi Mobile® App in 3 easy steps now.

Citi Mobile® App

Receive push notifications when there are activities or updates on your Citi Credit Card/Ready Credit Card: transactions, payment due, payment received, 95% of Credit Line Reached and more.

For a full list of alerts you can receive via push notifications on your Citi Mobile® App and other FAQs, click here.

Receive push notifications when there are updates on your Citi accounts for: Account Credit, Credit Card/Ready Credit Payment Received, 95% of Credit Line Reached, Time Deposit Due for Maturity in 4 days and more.

For a full list of alerts you can receive via push notifications on your Citi Mobile® App and other FAQs, click here.

- Touch ID

Too many passwords to remember? Access your account with your fingerprint, simply and securely.

Important information: Touch ID is only available on iPhone 5s and newer IOS devices supporting fingerprint login. Please do not activate Touch ID™ and Sensor for the Citi Mobile® App if you have any other person's fingerprint saved on your device. Activating fingerprint sign in means that any fingerprint saved on your phone, now or in the future can access your Citi Mobile® App. Your user ID will be stored in the app, you can turn this feature off any time via "Setting" feature. iPhone and Touch ID™ Sensor are trademarks of Apple Inc. registered in the U.S and other countries. Learn more here.

- Other Key Features

If you are reading this on your smartphone,

Click here to download the Citi Mobile® App directly.

Alternatively, you can download the app via one of the following methods:

- Search for "CitiBank SG" in the App Store or Google Play on your smartphone; or

- SMS "CITIMOB" to 72484 to get the download link from us.

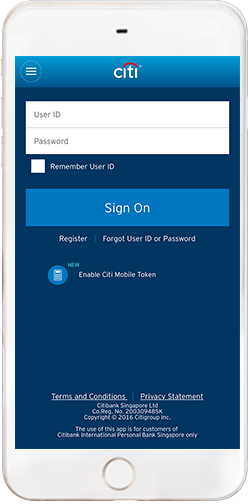

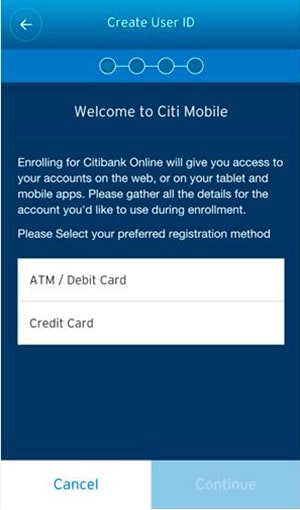

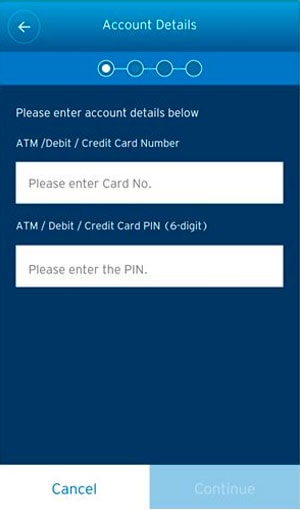

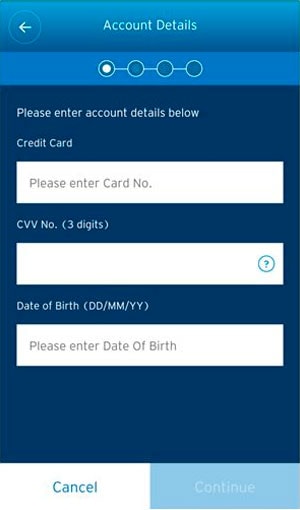

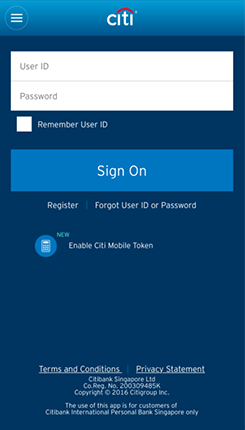

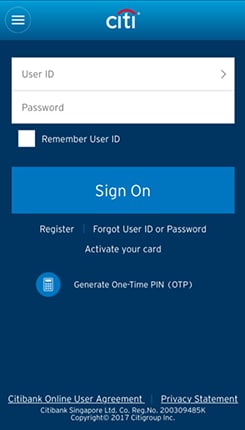

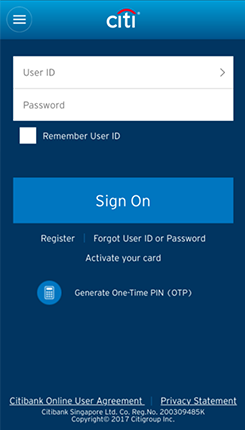

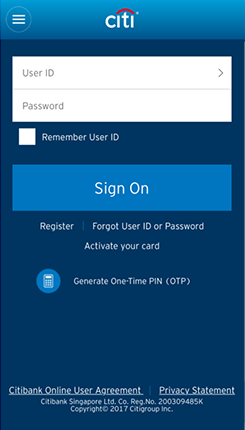

Login to Citi Mobile® App with your existing Citibank Online User ID and Password.

- Don't have login credentials? Create them directly on the Citi Mobile® App.

Click on  to expand and on

to expand and on  to minimize the details.

to minimize the details.

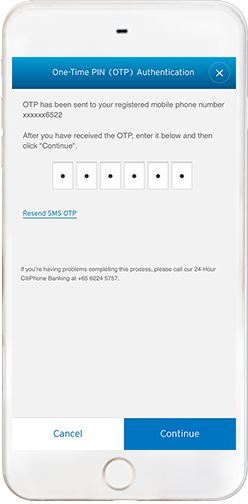

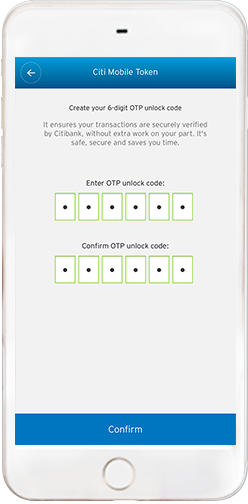

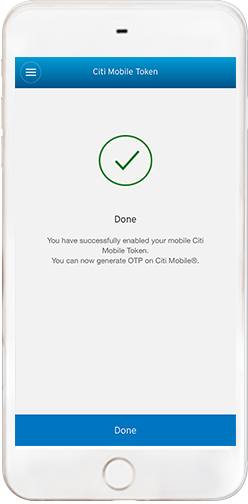

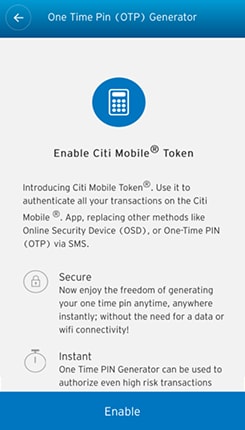

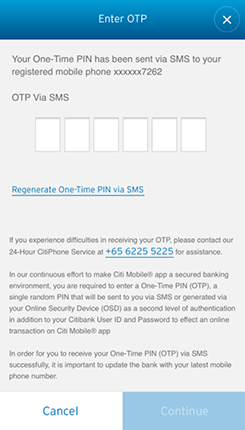

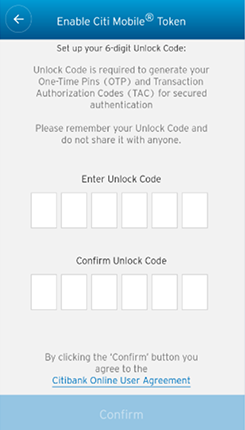

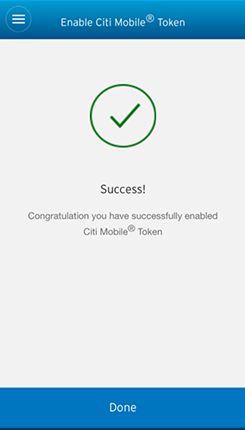

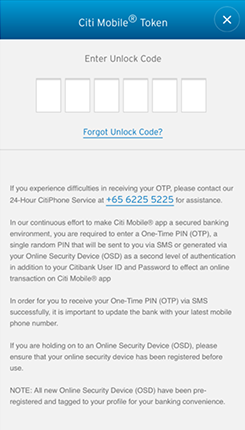

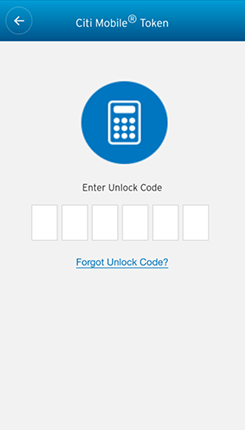

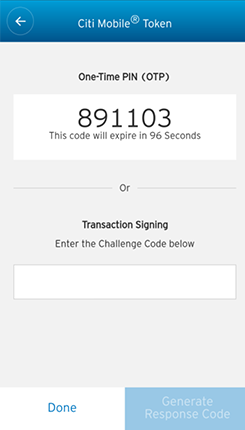

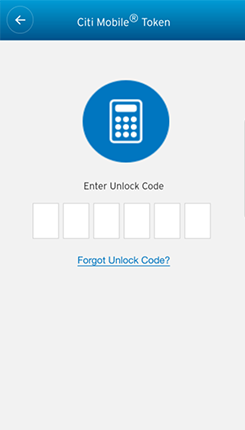

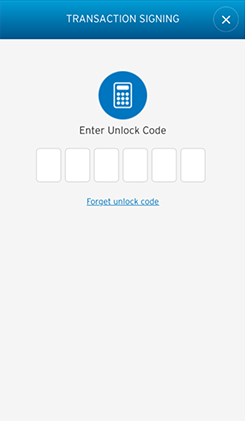

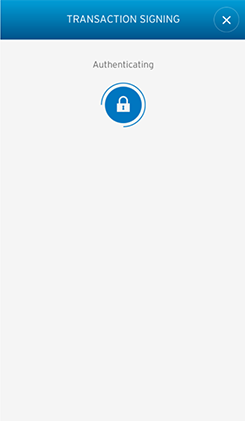

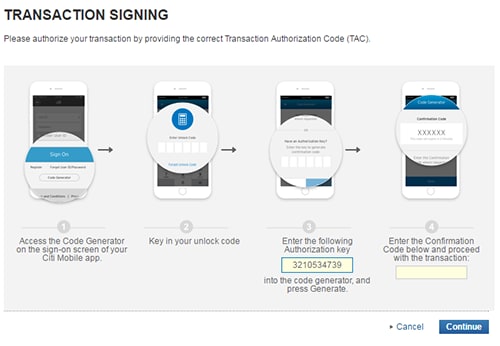

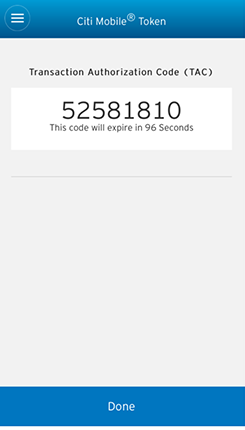

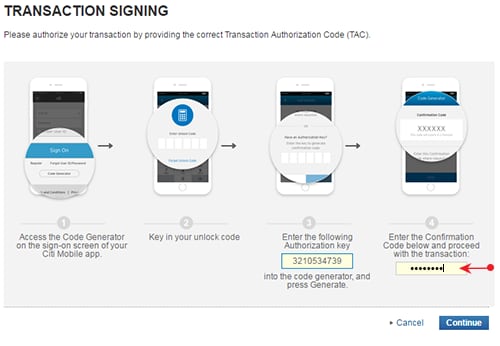

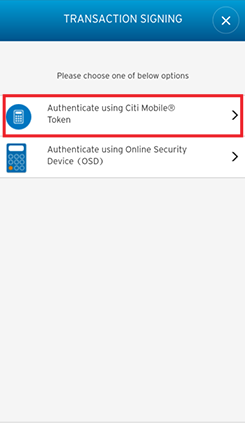

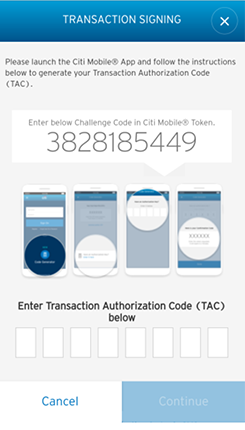

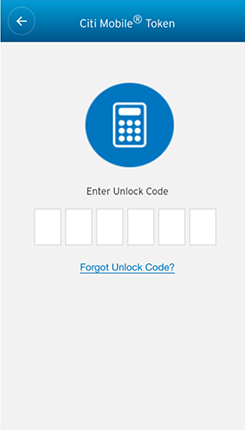

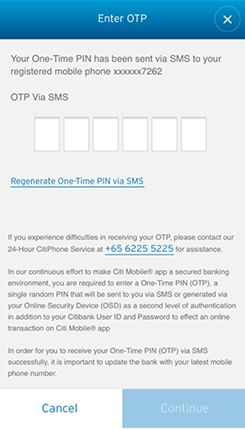

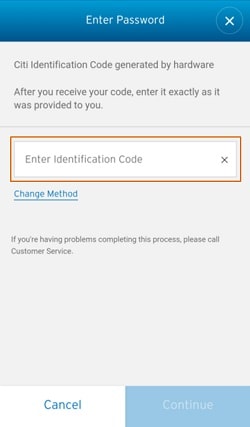

Citi Mobile® Token is a feature within the Citi Mobile® App that authenticates transactions, as an alternative to other authentication methods such as Online Security Device, or One-Time PIN (OTP) via SMS. You may still use your Online Security Device or OTP via SMS to authenticate transactions. Please note that the Citi Mobile® Token can only be enabled with the Citi Mobile® App on one mobile device.

The benefits of Citi Mobile® Token are:

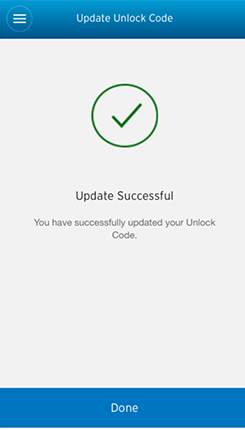

- Protected by a 6-digit Unlock Code chosen by you, and is restricted to one mobile device of your choice.

SECURE - Enter your unique Unlock Code to instantly authenticate your transactions initiated in

INSTANT

Citi Mobile® App on your

Citi Mobile® Token enabled device. No more waiting for an OTP via SMS, or worrying about misplacing your Online Security Device. - Authenticates all online transactions such as payments and transfers, adding a new payee, and updating your contact details. It also generates OTP for online purchases.

EASY

Citi Mobile® Token can be used in the following scenarios:

- Authenticate instantly with your unique Unlock Code for all transactions initiated in the Citi Mobile® App on your Citi Mobile® Token enabled device.

Citi Mobile® App - Instantly generate an OTP or Transaction Authorization Code (TAC) with your unique Unlock Code, to authenticate all transactions on Citibank Online.

Citibank Online - Instantly generate a One-Time PIN (OTP) with your unique Unlock Code for online purchases.

When making payment for online purchases

The unique Unlock Code ensures that only you have access to Citi Mobile® Token on your device and can generate a One-Time PIN (OTP) and / or Transaction Authorisation Code (TAC). Please remember your Unlock code and do not share it with anyone.

Yes, you can still use your Online Security Device or get OTP via SMS. However, with the Citi Mobile® Token, if you are making transactions in the Citi Mobile® App on your Citi Mobile® Token enabled device, authentication is instant when you enter your unique Unlock Code. There's no need to wait for OTP via SMS, or worry about misplacing your Online Security Device.

Once you have registered for the Citi Mobile® Token, it becomes your primary mode of authentication for all transactions made through the Citi Mobile® App. The option to use Online Security Device or OTP via SMS will be made available only if your authentication via the Citi Mobile® Token is unsuccessful.

No, you will not be able to use Citi Mobile® Token without installing the Citi Mobile® App.

Click here to download the Citi Mobile® App.

If you have lost your mobile phone, there are 3 ways to disable your Citi Mobile® Token:

- Login to your Citibank Online account on your browser and follow these steps:

>Services > My Profile > Deactivate Citi Mobile® Token - By enabling Citi Mobile® Token on another mobile device,. Citi Mobile® Token will automatically be deactivated on the previous mobile device.

- Call CitiPhone at +65 6225 5225 to deactivate your Citi Mobile® Token.

Simply enable the Citi Mobile® Token on your new mobile device, the Citi Mobile® Token will be automatically deactivated on the previous device.

Click here to learn how to enable Citi Mobile® Token.

No, you will not be able to generate One-Time PIN (OTP) and / or Transaction Authorisation Code (TAC) on the old device to authenticate your transactions. For security reasons, you can register for Citi Mobile® Token in one device only. If you have enabled the Citi Mobile® Token on a new device, the Citi Mobile® Token in the previous device will be automatically deactivated.

Please call your Relationship Manager or our CitiPhone hotline at +65 6225 5225 for assistance.

Click on  to expand and on

to expand and on  to minimize the details.

to minimize the details.

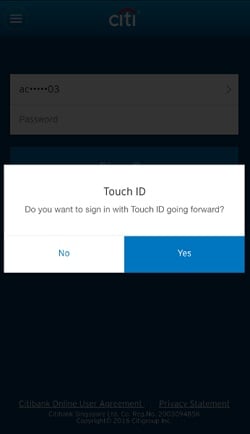

Touch ID is a feature that enables login authentication based on fingerprints stored on your Apple iphone device; which is an alternative login mechanism to Citi's User ID and Password.

This feature is available on Apple Mobile Phone Models 5S and newer. Android devices are not supported currently.

Your fingerprint information is stored on your Apple device's Secure Element. Once you enable Touch ID as a login method for your Citi Mobile® App, an encrypted token is created and stored in Citi Mobile® App and our Citi system. No login information is stored on the Citi Mobile® App

Enrollment of Touch ID Sensor for Citi Mobile® App is valid for 45 days. If you have not logged into the Citi Mobile® App by manually entering the password, Touch ID Sensor will be disabled for Citi Mobile® App. This will not impact any other Touch ID Enrollment you have on your device.

Touch ID recognizes all fingerprints registered in your device. For security reasons, we recommend that you do not register third party finger prints in your device. This is to protect not just your Citibank account but the rest of your personal details in your phone.

No, Touch ID sensor will not work if the service provider has changed in the overseas country.

Changing the mobile number will not disable Touch ID sensor as long as SIM card and the service provider remains the same.

There are a few reasons why your Touch ID may have been turned off:

- You have changed your service provider

- You have recently changed your User ID or Password

- You have not logged into your Citi Mobile® App by entering your password for the past 45 days

- You might have changed your SIM card

- Your online account is locked because you have exceeded the maximum number of password tries

- You have entered the wrong OTP when signed on for 3 times

- You have enabled Touch ID sensor for your account on a different device

- Your Citibank User ID is deleted in our system

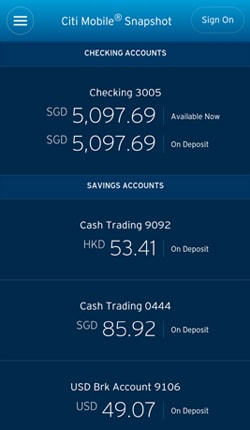

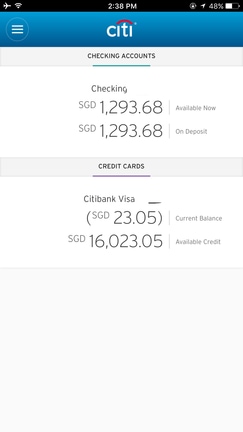

When you enroll in Citi Mobile® App Snapshot, you can view the balances for your Checking, Savings, Ready Credit and Credit Cards accounts without entering your User ID and Password every time. You need only refresh and enter your password from time to time, every 45 days. For added protection, we recommend you secure your mobile device with a password.

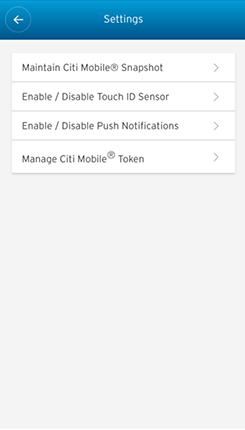

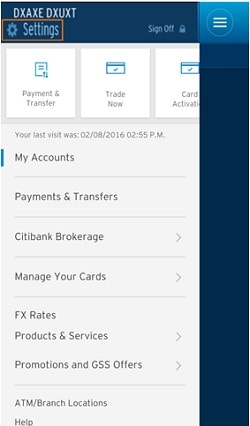

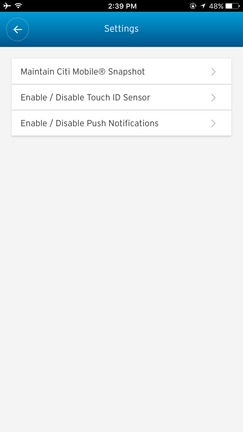

It's simple. Login, go to the app 'Settings' and enable Citi Mobile Snapshot

At the moment, you will not be able to customize accounts to view.

No, Snapshot function is not available on Citibank Online and mobile browser.

For Android Users: Once you call your service provider to disable the SIM Card, Snapshot will be automatically disabled.

For Android and IPhone Users:

- Changing your Citibank Online User ID and Password will disable Snapshot.

- Enrolling in a new device will disable Snapshot in your lost mobile phone.

We value our customers privacy and security, so we will automatically disable your Snapshot after 45 days if you have not logged into your Citi Mobile® App.

Yes, you can use Snapshot in your tablet as long your tablet has a service provider and SIM Card associated with it.

There are a few reasons why Snapshot may have been turned off:

- A change in your service provider

- You have recently changed your User ID or Password

- Someone else has used your Snapshot enabled device to log in to their account

- You have not logged into your Citi Mobile® App for the past 45 days

- You changed your SIM card

- Your Online account is locked because you exceeded the number of password entry attempts

- You entered the wrong OTP 6 times when signed on.

No, Snapshot if the service provider changes when you are overseas.

Snapshot will be linked with your Primary SIM card. As long as Primary SIM card is available in the phone then Snapshot will work. Please note Snapshot will be disabled if the service provider has changed.

Changing your mobile number will not disable Snapshot as long as the SIM card and service provider remains the same.

For Android devices, Snapshot will be disabled when your SIM card is changed.

For iPhone, changing the SIM card will not disable Snapshot.

Yes, Snapshot will be disabled if you change your service provider; even if the phone number remains the same.

You can view the balances of the following accounts in Snapshot:

- Checking accounts

- Savings accounts

- Ready Credit accounts

- Credit Card accounts

To view the rest if your account balances, just log in to your Citi Mobile® App with your User ID and Password.

You can turn off Snapshot by signing on to your mobile app and disabling it using the 'Settings' option

You will need to own the following accounts to use Snapshot:

- Checking

- Savings

- Ready Credit

- Credit Cards

In addition, you will need to have a:

- Valid mobile phone number registered with Citi

- Citibank Online account

- Valid SIM card and network service provider

To enable Snapshot, the User ID needs to be rememebered by the device as it is one of the authentication parameters for using Snapshot

- Citi Mobile® App Snapshot

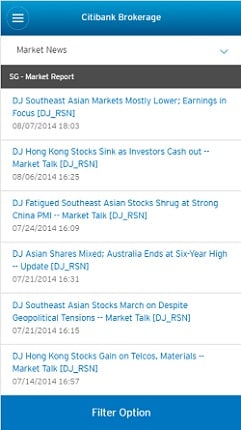

- View 150 latest transactions for all your accounts.

- Ease of searching for specific transactions based on dates, amount or transaction type (transactions made in last 3 months)

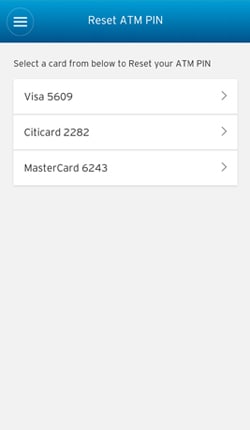

- Reset ATM PIN

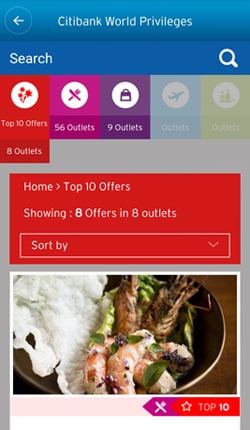

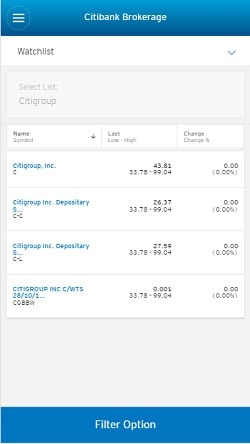

- Add stocks to your Watchlist

- Faster access to functions via the Quick Task Menu

You cannot customize your quick task menu as it is predetermined.

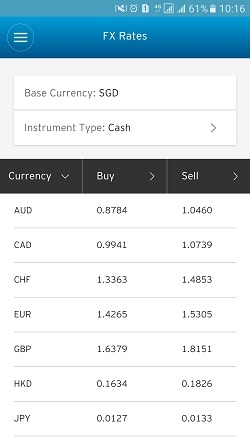

For Android users, the daily currency update will be downloaded onto your mobile phone as a separate document in pdf format .

For IPhone users, the document will be displayed in your browser.

You can now change your ATM, Debit and/or Credit card PIN on the go using your Citi Mobile® App

Going forward customers are required to choose the source of fund (SOF) account first and then based on the selected SOF, the destination account will be displayed.

Here are the new capabilities introduced:

- Search transaction using Date (Up to 150 transactions performed in the last 3 months)

- Search transactions using Amount

- Search transaction using Transaction type

You will be able to see 150 transactions for each account

For your convenience, our app can remember up to 5 user names for your ease of logging in.

Terms and ConditionsTerms and Conditions

Citi Mobile® App Terms and Conditions

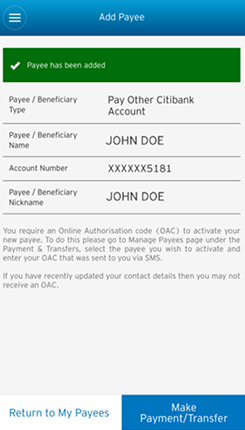

For payments and transfers via Citi Mobile, the payee will first have to be added on Citibank Online and activated with an Online Authorisation Code (OAC). All payments and transfers are subject to the Citibank Online User Agreement. Some or all of the services (including payments and transfers) that may be accessed through Citi Mobile or Citibank Online may not be available during our scheduled maintenance times. In the event of such unavailability, you may call our 24-Hour CitiPhone Banking at 6225 5225 or visit a Citibank branch to conduct your banking transactions. Citibank exercises no control and assumes no responsibility for any delay, misconnection, variation in response times and connectivity of any Internet Service Provider (whether local or overseas) through which access to Citi Mobile and/or Citibank Online is effected. Citibank full disclaimers, terms and conditions apply to individual products and banking services.

SMS CITIMOB to 72484

SMS CITIMOB to 72484